Recognizing the Common Reasons People Seek Bankruptcy Services for Financial Alleviation

In the world of financial security, people usually locate themselves browsing turbulent waters because of unexpected situations that can lead to seeking insolvency solutions for relief. The complex internet of financial commitments can in some cases come to be overwhelming, prompting a requirement for tactical options to reclaim control. When facing insolvency, the factors behind this decision are as diverse as they are impactful, clarifying the hidden factors that drive individuals to seek expert aid. From unforeseen clinical emergency situations to the aftermath of company endeavors gone awry, the inspirations behind getting to out for financial support are complex and can use insights into the complex nature of individual finance administration.

Sudden Medical Costs

Regularly, people look for bankruptcy services because of the monetary burden imposed by significant and unforeseen clinical costs. Despite having insurance policy coverage, the out-of-pocket costs related to medical emergencies can rapidly collect, leading to frustrating financial obligation. In such difficult conditions, looking for bankruptcy solutions comes to be a viable choice for individuals making every effort to reclaim economic security.

Sudden medical expenditures can arise from numerous resources, including unexpected diseases, accidents, or the need for urgent medical treatments. The high costs of healthcare facility keeps, surgical procedures, medicines, and rehabilitation services can deplete financial savings and push people right into economic distress (Business Insolvency Company). In spite of initiatives to budget and prepare for medical care expenditures, the unforeseeable nature of health-related emergency situations can catch also the most ready people off guard

In addition, the effect of abrupt clinical expenses is not limited to the economic world. The anxiety and anxiousness stemming from mounting medical costs can take a toll on a person's psychological and mental health. By looking for insolvency services, individuals can work in the direction of handling their clinical financial debt in a structured fashion, intending to minimize monetary stress and lead the way for a fresh financial start.

Unemployment and Income Loss

Dealing with unexpected job loss and a decrease in earnings can trigger individuals to look for bankruptcy services as they browse through monetary unpredictability. Unemployment or a substantial reduction in revenue can promptly undercut a person's monetary situation, resulting in battles with satisfying financial obligation commitments and day-to-day costs. When confronted with such conditions, individuals might locate it testing to maintain their financial stability and might look for the support of bankruptcy services to help them handle their debt and discover a means to regain control over their finances.

Joblessness can result from various variables such as discharges, company closures, or financial slumps, leaving individuals with limited options to create earnings. The loss of a consistent revenue stream can produce a cause and effect, impacting one's capacity to repay financial obligations and maintain a particular requirement of living. In such cases, seeking bankruptcy services can give people with the needed assistance and assistance to navigate these challenging economic times, using services customized to their particular situations. By attending to the root triggers of economic distress, people can work towards restoring their monetary wellness and safeguarding a more stable future.

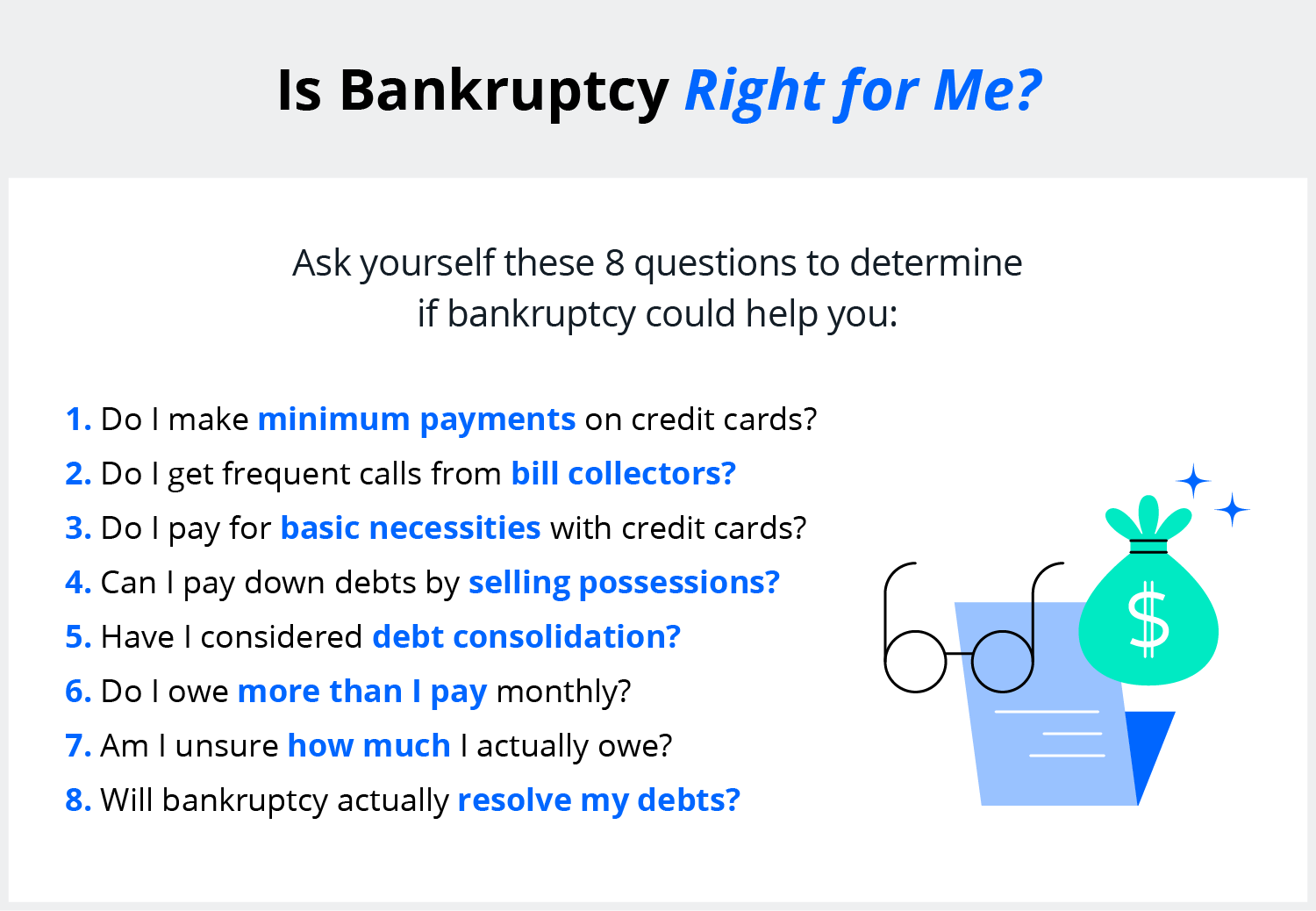

Mounting Bank Card Financial Debt

As individuals come to grips with the repercussions of joblessness and revenue loss, the buildup of mounting charge card debt arises as a pushing problem in their financial battles. Bank card, commonly made use of as a monetary safety and security web during times of demand, can lead to considerable financial debt when not taken care of properly. High-interest rates on exceptional balances worsen the trouble, making it challenging for people to keep up with payments and triggering the financial debt to snowball with time.

Seeking insolvency services to attend to installing charge card debt can supply people with the essential assistance and support to navigate their financial obstacles. Via financial debt consolidation, arrangement with financial institutions, or personal bankruptcy process if needed, people can work towards achieving financial security and a fresh start.

Business Failing and Insolvency

What factors contribute to companies facing bankruptcy and seeking bankruptcy defense? Market fluctuations, financial slumps, and modifications in customer behavior can dramatically impact a company's financial security.

When a company is incapable to produce sufficient profits to cover its expenditures or repay its financial debts, looking for bankruptcy security may come to be an essential action. Filing for bankruptcy permits a battling business to rearrange its debts, discuss with creditors, and potentially continue procedures under court supervision. While bankruptcy is commonly deemed a last resource, it can give a path in the direction of monetary restructuring and a chance for the organization to recuperate from its monetary distress.

Divorce and Separation

Seeking insolvency solutions during a separation or splitting up can offer individuals with the necessary support to manage financial obligations, restructure finances, and establish a new financial foundation post-divorce. Bankruptcy experts can supply guidance on debt consolidation, settlement with creditors, and lawful processes connected to bankruptcy. By looking for help during this challenging time, individuals can work towards why not look here securing their financial future and alleviating the unfavorable effects of the separation on their economic wellness.

Conclusion

In final thought, people seek bankruptcy solutions for different reasons such as sudden clinical costs, unemployment, charge card financial debt, organization failure, and separation. These economic obstacles can lead people to look for relief with insolvency solutions to aid handle their debt and reclaim financial security. Recognizing the usual factors behind seeking bankruptcy services can offer insights right into the different circumstances that people may face in their trip towards financial healing.

By looking for insolvency services, individuals can function in the direction of managing their medical debt in an organized fashion, aiming to reduce monetary stress and pave the way for a fresh financial begin. - Business Insolvency Company

By addressing the root triggers of monetary distress, individuals can function in the direction of rebuilding their monetary wellness and safeguarding a much more steady future.

While insolvency see is typically watched as a last hotel, it can provide a course in the direction of financial restructuring and an opportunity for the business to recoup from its financial distress.